The Cost Development System (CDS+PLUS) helps you run a profitable manufacturing operation by providing a clear and accurate picture of your product's costs. Product cost includes not only the direct material and labor, but also that product's share of every other expense of doing business. These indirect costs are typically assigned to the product through various overhead allocation methods.

The Bill of Material System (BMS+PLUS) and Process and Routing System (PRS+PLUS) provide the basic database for developing standard costs. BMS+PLUS provides both the item information such as shrinkage percent and costing options, and the bill of material information such as the quantity and scrap allowance of component materials. PRS+PLUS supplies the standard process and routing information such as run hours, setup hours, yield rates, labor grades, work center identifications, work center efficiency factors, and outside vendor costs.

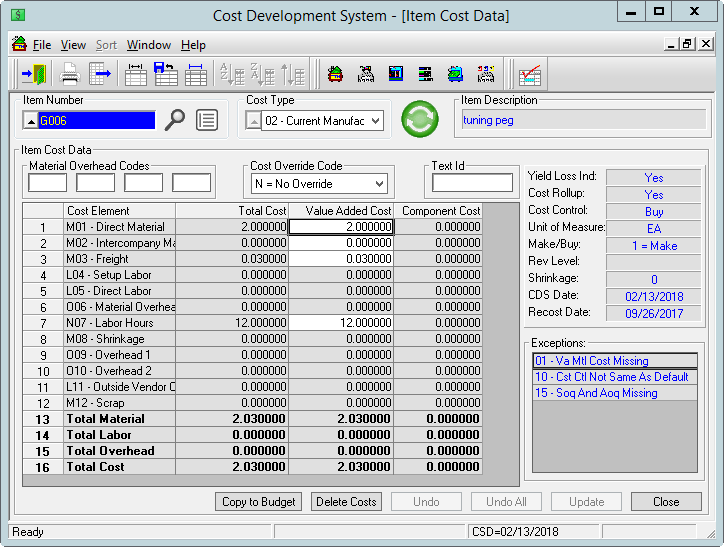

CDS+PLUS maintains purchased material costs, labor rates, and overhead rates necessary to accurately develop each product's cost. This information, along with the bills and routings, is used to calculate, or "roll up", material, labor, and overhead costs for each product on a level-by-level basis. CDS+PLUS uses this integrated costing approach to provide detailed product cost information and flexible "what if?" cost simulation capabilities.

The major features of the Cost Development System are:

- Multiple cost types

- Simulated costs

- Cost comparison analysis

- Cost element structure

- Flexible labor cost development

- Flexible overhead calculation

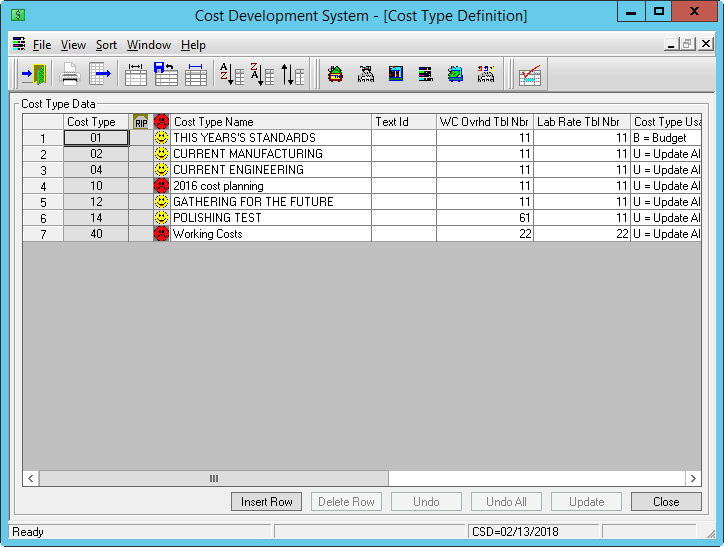

Multiple Cost Types

CDS+PLUS provides flexibility in determining your product costs, or retaining previous period costs, by providing up to 99 different types (or versions) of cost per item. You can easily tailor each cost to your individual needs. Each cost type is composed of up to 12 value-added and 12 cumulative user-defined cost elements.

CDS+PLUS provides predefined cost types to support the standard cost accounting techniques typically used by manufacturing companies. You can, however, easily use these versions to support other cost accounting methods. The available cost types are:

- Budgeted or frozen standard

- Current manufacturing

- Simulated

- Current engineering

- Next period standard

- Reserved for future use

- User defined

- Simulated costs

Simulated Costs

Simulated costs are developed using any user-defined combination of bills of material, routing, purchased material costs, labor rates, overhead rates, cost element definitions, and cost calculation options. This cost type is used in analyzing the impact of proposed changes in material, labor, and overhead costs, and changes in product structures and routings.